BanG Dream! (Bandori) Girls Band Party! (Garupa) is a rhythm game released for iOS and Android, based on the BanG Dream! franchise. This time, we will be providing an analysis on the user popularity of the five bands featured in the game based on the real data collected from the Band Story 2 events for the Japanese version of the game, provided by Mobile Index.

Information provided by mobile app market analysis service Mobile Index; original report published on November 7, 2018.

The total sales of in-game purchases were collected in 2018 during the period between the starting date of the five bands’ (Poppin’ Party, Roselia, Pastel*Palettes, Afterglow, and Hello, Happy World!) respective Band Story 2 events and a week after. Along with the total sales, the active users for each event were also collected; the numbers are defined as WAU (weekly active users), representing the number of unique users who actively logged into the game within the first week from the event’s release.

From the information of total sales for each respective band, we can see that Roselia had the highest-grossing sales with 700 million yen, with Hello, Happy World! at the last place with 360 million yen.

The following ranking of the bands has them sorted from the highest-grossing to the lowest:

- Roselia – 700 million yen

- Pastel*Palettes – 500 million yen

- Poppin’ Party – 480 million yen

- Afterglow – 390 million yen

- Hello, Happy World! – 360 million yen

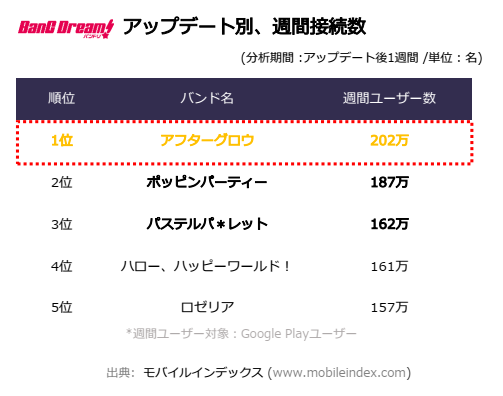

However, we’ll find a very different result when looking at the number of active users. Afterglow is the band with the highest number of WAU, 2.02 million users. On the other hand, Roselia which had the highest-grossing sales had the lowest number of WAU, clocking at 1.57 million users.

When we sort the bands from the highest WAU, we will end up with the following ranking:

- Afterglow – 2.02 million users

- Poppin’ Party 1.87 million users

- Pastel*Palettes – 1.62 million users

- Hello, Happy World! – 1.61 million users

- Roselia – 1.57 million users

As both of these parameters gave us very different standings, we need to find which one provides a more accurate representation for a band’s popularity. In this regard, sales have less bearing in being used as a determinant due to it being influenced by a lot of other factors. In order to put that into context, we’ll compare the game’s sales before and after the update for each Band Story 2 event.

As you can see, Roselia’s Band Story 2 event multiplied the game’s sales by 4.6 times, followed by Pastel*Palettes (2.5 times), Afterglow (2.1 times), and Poppin’ Party (1.7 times). On the contrary, Hello, Happy World!’s sales dropped by 2.2 times compared to the previous event. However, there is a catch — Hello, Happy World!’s Band Story 2 event was preceded by a limited Halloween gacha, which grossed 810 million yen due to serving as a higher incentive for the users to perform in-game purchases. This means that Hello, Happy World!’s Band Story 2 event sales might not have been an accurate representation of the band’s popularity.

From this finding, we can surmise that the number of active users is a more reliable indicator to determine a band’s popularity among the users, as it directly represents the number of users actually engaging in the respective band’s story event instead of being dependent on a small portion of the user-base’s in-app purchases. Of course, various other factors are also in place when determining sales, like how some users may look for a specific pickup member, type, or skill in a gacha period.

In conclusion, the band which has gained the most popularity in 2018 among the users is Afterglow. In contrast, the band which has the most fans willing to spend money due to various reasons (such as tiering in the event) despite having the least number of active users is Roselia.

Addendum

The following is a comparison of Bushimo (Bushiroad Mobile) total sales along with the sales proportion of its published games in the first ten months of 2017 and 2018. As can be seen in the chart, Bushimo’s sales in 2018 increased by around 25% compared to 2018. Meanwhile, Garupa’s sales reached 15.5 billion yen, a 48% increase of proportion from the previous year, making it the highest-grossing game among titles published by Bushimo above Senki Zesshō Symphogear XD Unlimited (2.7 billion yen) and Love Live! School Idol Festival (7 billion yen).